As Abu Dhabi realty prices stabilise, residential yields firm up

Real estate sales prices and rental rates in Abu Dhabi saw a marginal decline during the third quarter, which analysts say could indicate the market is close to bottoming out. Average apartment sales prices dropped by 1 per cent during the quarter, with villas showing no movement, according to Chestertons’ Observer: Abu Dhabi Market Report Q3 2019. A similar trend was seen in the rental market where average apartment rents went down 1 per cent, while villa rates remained stable from the previous quarter.

"There is no significant new supply expected to be delivered next year, which means there could be a better balance between supply and demand,” said Nick Witty, managing director of Chestertons. “This and a series of government initiatives, including allowing foreign nationals to own freehold properties, will ultimately lead to a more stable market as we move into 2020."

Solid yields

According to ValuStrat’s Abu Dhabi Real Estate Market Report, residential rental values in Abu Dhabi declined 9.2 per cent annually during the third quarter, a slower rate of decline compared with residential capital values, which were 12.6 per cent lower than last year. This has resulted in strong yields for investors in the emirate.

"Abu Dhabi is enjoying relatively high residential yields across the board; this is due to the fact that rental value falls are slower than capital value declines," said Declan King, managing director and group head of real estate at ValuStrat.

According to ValuStrat, Abu Dhabi’s gross yields averaged 7.4 per cent during the quarter — 7.7 per cent for apartments and 6.6 per cent for villas.

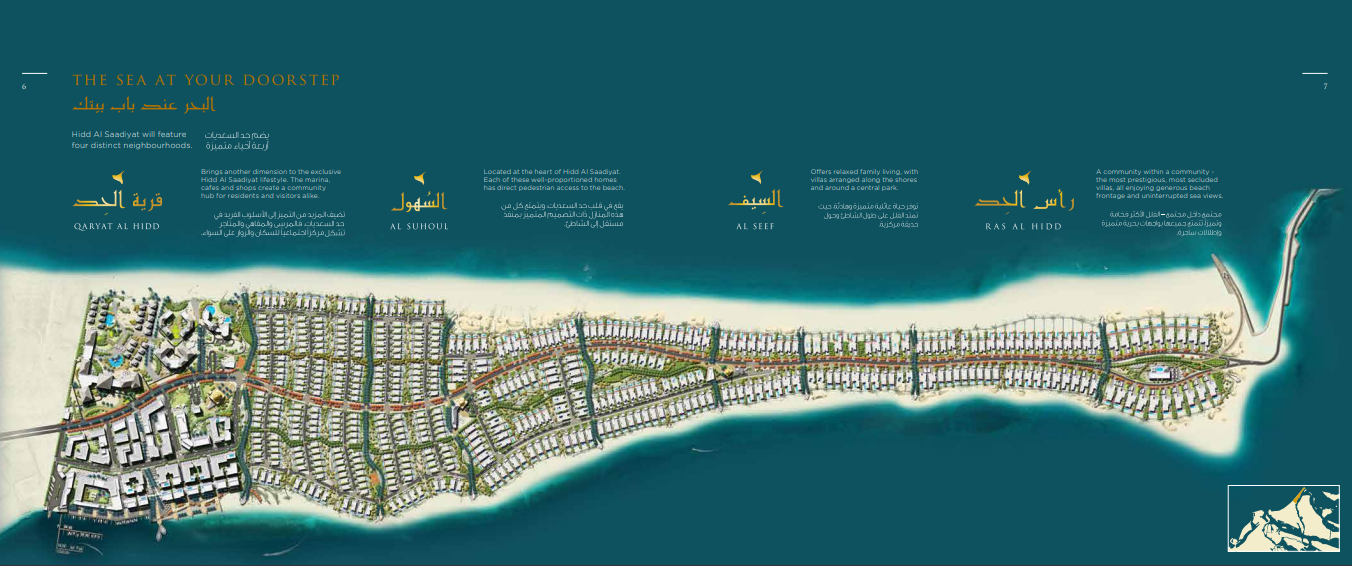

In the sales market, a number of key areas are showing signs of resiliency, according to Chestertons, including Saadiyat Island, which saw no price adjustment in apartment prices during the third quarter after absorbing an 8 per cent decline in the previous quarter. Moreover, this indicates that the price point is now in line with market demand for this style of property at Dh1,400 per square foot, according to Chestertons. Al Reem and Al Ghadeer saw a drop of 1 per cent to Dh965 per square foot and Dh740 per square foot, respectively, while Al Raha Beach and Al Reef saw the highest price declines at 2 per cent quarter-on-quarter to Dh1,280 per square foot and Dh797 per square foot.

With the villa sales market even more resilient, only Al Reef and Al Ghadeer showed modest declines of 1 per cent to Dh620 and Dh695 per square foot respectively, according to Chestertons. Prices in Al Raha Beach Area, Khalifa City and Al Raha Gardens remained at Dh1,160, Dh872 and Dh700 per square foot respectively.

"Overall the capital’s real estate sector is showing signs of positive sentiment with a marked slowdown in sales price reductions. Developers are also recognising the need to be more creative to encourage sales and are now offering flexible payment plans and, in several instances, waiving the registration fee,” said Witty. “We have also seen developers selling land plots to boost revenues. This type of purchase is expected to prove popular with Emiratis, however, we could also see this pique the interest of other nationalities if positioned correctly."

Rents

In the rental market, Mohammed Bin Zayed City and Al Raha Beach bucked the trend and saw a modest 1 per cent increase in average rental rates in the third quarter. Rents for two- and three-bedroom apartments in Al Raha Beach Area are now Dh125,000 and Dh169,000 per year respectively. One-bedroom apartments in Mohammed Bin Zayed City saw the biggest gain with a 5 per cent increase in rent to Dh40,000 per year.

Overall, apartment rents were down 1 per cent in the third quarter, with Chestertons attributing this to a growing demand for affordable communities from price-conscious tenants.